how much is capital gains tax in florida on stocks

Individuals and families must pay the following capital gains taxes. The amount of taxes youre responsible.

Restricted Stock Units Jane Financial

Since 1997 up to 250000 in capital gains 500000 for a married couple on the sale of a home are exempt from.

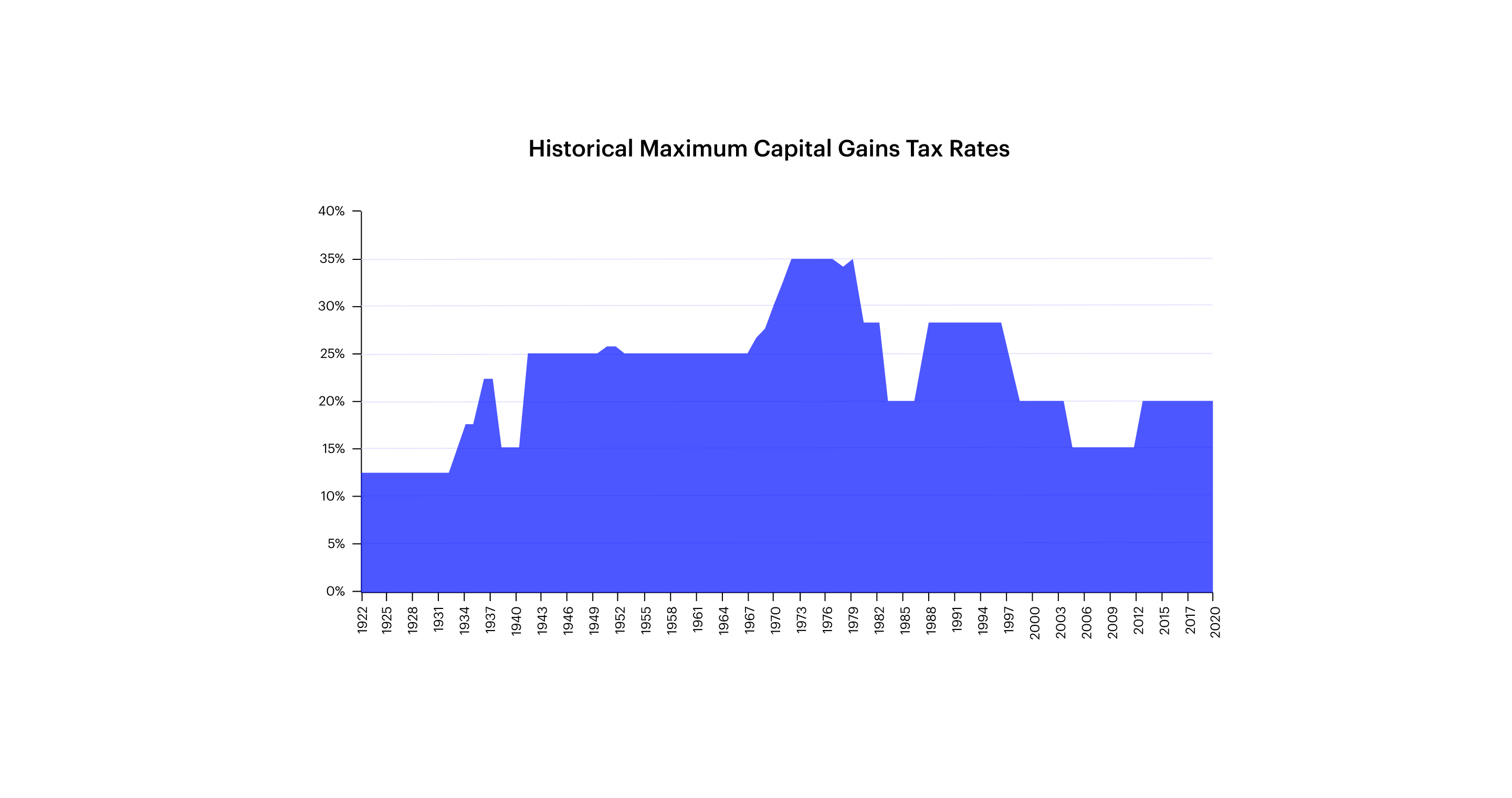

. Weve got all the 2021 and 2022 capital gains tax rates in one place. The federal capital gains tax rate is currently up to 25. Floridas capital gains tax rate depends upon your specific situation and defaults to federal rules.

You may have just sold a stock for a 20 gain but after state and federal taxes your gain may. However you will still owe federal capital gains tax on your sale. Federal-level capital gains tax Despite the absence of capital gains tax required by the state Floridians are still subject to federal taxes.

Capital gains taxes on assets held for a year or less correspond to ordinary income tax. Florida Capital Gains Tax. Florida Cap Gains Tax.

Capital gains are the profits you make when you sell a stock real estate or other taxable asset that increased in value while you owned it. For example a single person with a total short-term capital gain of. The capital gains tax rate is 0 15 or 20 on most assets held for longer than a year.

If your taxable income is less than 80000 some or all of your net gain may even be. Therefore if you receive capital gains in florida there is no tax regardless if section 1202 100 tax exclusion on capital gains from the sale of qsbs applies. The Rules You NEED to Know 4 days ago Jul 12 2022 Its called the 2 out of 5 year rule.

5 rows Does Florida Have Capital Gains Tax. The capital gains tax on most net gains is no more than 15 percent for most people. 2022 long-term capital gains taxes can range from 0 to 20 based on your tax bracket and filing status.

The calculator on this page is designed to help you estimate your. Best Robo Advisors How to Invest in Stocks 401k Retirement Calculator. Ncome up to 40400.

It lets you exclude capital gains up to 250000 up to 500000 if filing. The capital gains tax is based on that profit. A big negative of capital gains taxes is that they cut into your return on investment.

2022 federal capital gains tax rates. Federal Cap Gains Tax vs. Just like income tax youll pay a tiered tax rate on your capital gains.

Capital Gains Tax Rate.

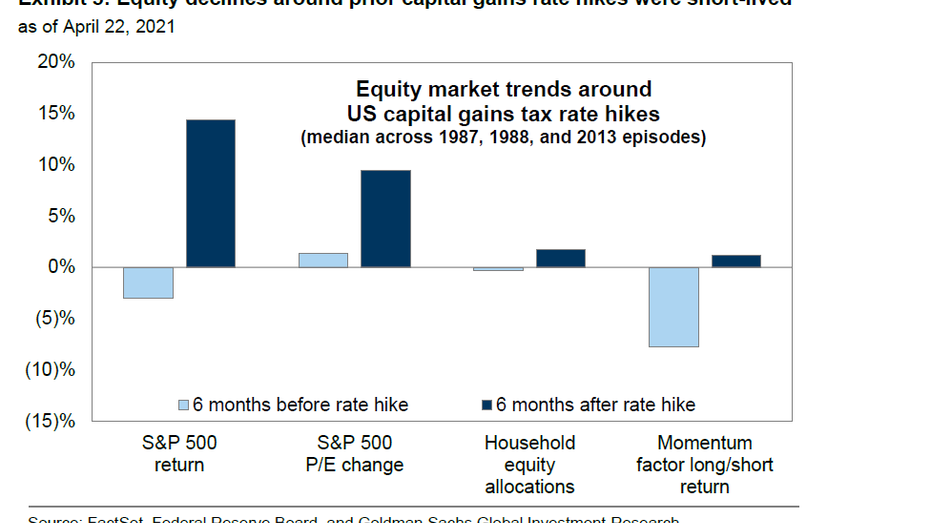

Capital Gains Tax Hikes And Stock Market Performance Fox Business

Florida Capital Gains Taxes What You Need To Know 2022 Michael Ryan Money

Schedule D How To Report Your Capital Gains Or Losses To The Irs Bankrate

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

How Much Is Capital Gains Tax It Depends On Holding Period And Income

Reconciliation Bill Capital Gains Tax Proposals Tax Foundation

How To Avoid Capital Gains Taxes In Georgia Breyer Home Buyers

Florida Capital Gains Tax The Rules You Need To Know Home Bay

Capital Gains Full Report Tax Policy Center

Capital Gains Tax Calculator Estimate What You Ll Owe

How To Avoid Capital Gains Tax On Stocks Smartasset

:max_bytes(150000):strip_icc()/2021StateIncomeTaxRates-2fb0a8148ecb444c8d1399d839a69ffb.jpeg)

State Income Tax Vs Federal Income Tax What S The Difference

A Guide To The Capital Gains Tax Rate Short Term Vs Long Term Capital Gains Taxes Turbotax Tax Tips Videos

Long Term Capital Gains Tax What It Is How To Calculate Seeking Alpha

Capital Gains Tax Calculator Estimate What You Ll Owe

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

Florida Capital Gains Taxes What You Need To Know 2022 Michael Ryan Money

Capital Gains Tax Rate In California 2022 Long Short Term Seeking Alpha

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World